New Rules Impact Individual Income Tax Liabilities in China

On 30 June 2011, China’s National people’s Congress announced some major changes to the collection of individual income tax (IIT). These will undoubtedly have a large impact on employees but could also influence the payment practices of foreign-invested companies in China. The new rules will be implemented after the summer, on 1 September 2011.

1. The minimum threshold for IIT payments by Chinese employees has been raised from CNY 2,000 to CNY 3,500.

The minimum threshold was raised from CNY 800 to CNY 1,600 in 2006, then to CNY 2,000 in 2008. The new threshold means that Chinese employees who earn less than CNY 3,500 (approx. USD 540) will not pay any IIT, and employees that earn more will see their taxable income decrease as well. The biggest beneficiaries are low-income Chinese employees, though their employers who calculate wages on a net-basis will also see their costs reduced.

Despite suggestions in earlier drafts of these rules, the minimum threshold for IIT payments by foreign employees was not altered and remains CNY 4,800.

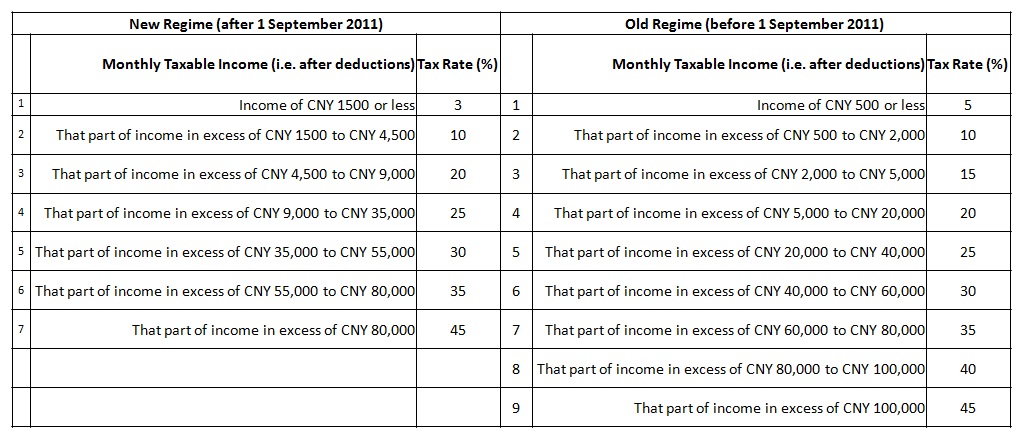

2. The current 9-bracket progressive tax rate system is replaced by a 7-bracket system, with the 15% and 40% brackets removed.

The level of IIT is calculated based on the individuals taxable income (after deduction of the first CNY 3,500 or CNY 5,800, see above). The amendment will impact high-income earners, especially those earn approx. CNY 19,000 or more. Companies that commit to a net salary in a contract will also be directly affected.

3. Below we compare the applicable tax rates before and after 1 September 2011:

Comments

Designed to benefit low-income earners in particular, company’s HR departments and pay-roll providers will have to ensure that the right amount of IIT is paid and deducted from salaries starting from 1 September 2011. Where employees – especially senior managers – are affected, employers should consider whether to provide additional compensation to cover any loss of actual income. In addition, companies that determine wages based on a net (after-tax) salary should ensure they are aware what addition burdens or savings the new rules will bring.